Energy companies sitting on more than £3 billion worth of consumer credit

Campaigners urge households to reclaim energy credit from suppliers ahead of household bills falling in July

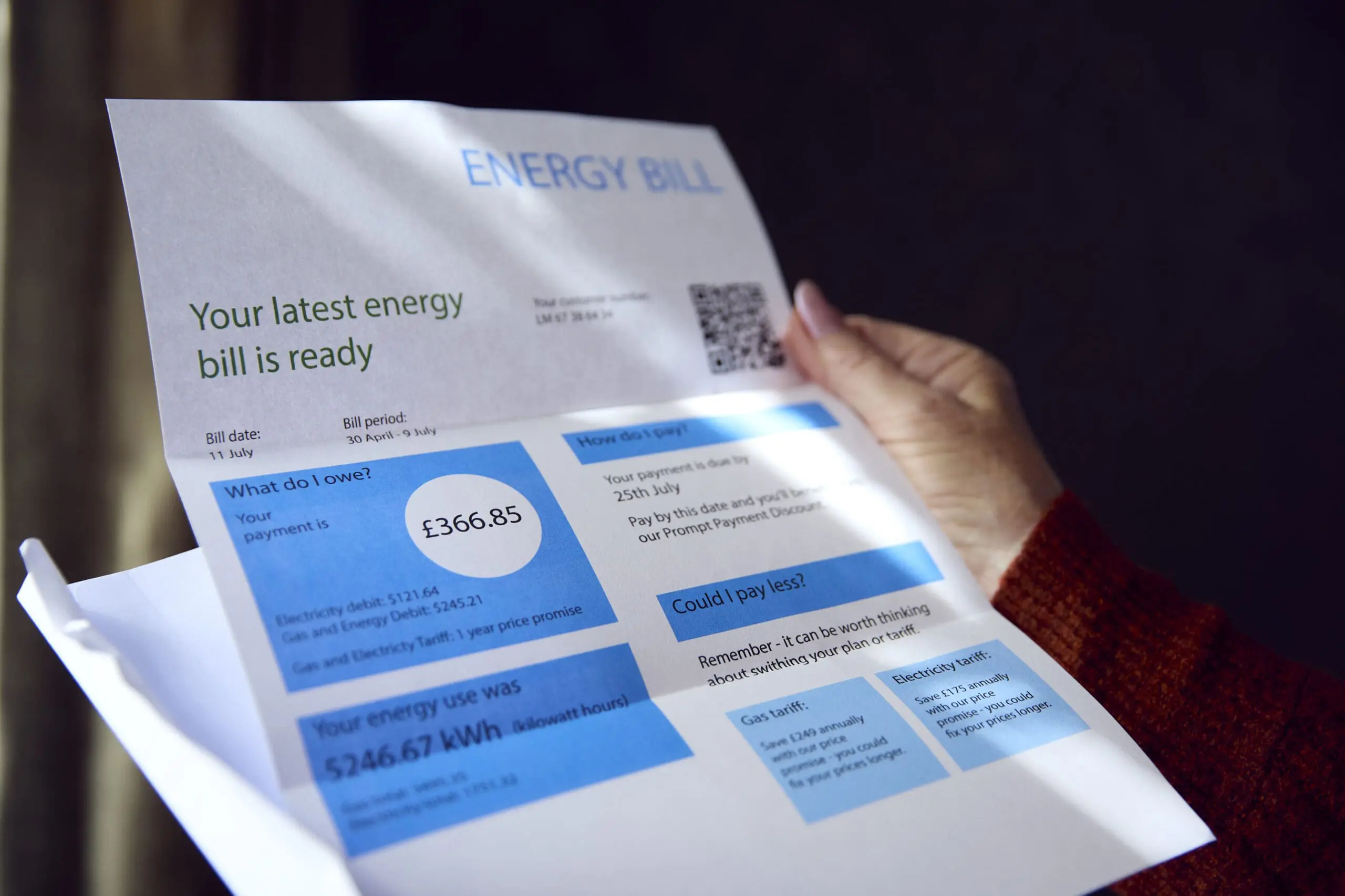

Campaigners are urging households to reclaim credit they have built up with their energy supplier in order to ‘reset’ direct debit payments that remain high as prices drop.

Figures from Uswitch suggest UK energy suppliers are currently retaining more than £3 billion worth of customer credit, with almost a third of UK households (32%) in credit all year.

Warm This Winter calculated that the combined bank interest likely to have been earned by firms from customer credit balances was at least £159 million in 2023 alone.

Warm This Winter spokeswoman Fiona Waters said:

‘Energy companies are sitting on over £3 billion of bill payers’ money whilst providing an appalling service in many cases and making billions in profits.’

Your energy rights

Read our advice on when you can claim compensation for poor energy supplier customer service, how to get money back if you’ve had a power cut and what to do if you’re struggling to pay your energy bill.

Household energy bills set to fall in July

The typical household energy bill will fall by £122 a year from July, but will still remain well above pre-pandemic levels. The fall reflects drops in wholesale energy prices – the amount energy firms pay for gas and electricity before supplying it to households.

The energy price cap was introduced by the Government in January 2019 and sets a maximum price that energy suppliers can charge consumers in England, Scotland and Wales for each kilowatt hour (kWh) of energy they use.

It aims to ensure that prices for customers on default energy tariffs are a fair reflection of the cost paid by suppliers for wholesale energy, and that the profit firms make is capped.

Ofgem sets its cap every three months as the average amount paid by the typical household.

It is important to note though that Ofgem’s cap does not set a maximum amount for the actual bill households receive – those who use more than the average amount will pay more, and those who use less will pay less.

Energy is regulated separately in Northern Ireland, where prices are also falling.

The Warm This Winter campaign, while stressing that customers should not cancel their direct debits as this could lead to higher unit costs being imposed on households, said early summer was the ideal time to reset energy payments for the year ahead.

Suppliers sitting on credit for many low income households

Research by the campaign suggests that 38% of those in permanent credit live in households with low incomes, and who may have cut back on energy use or other essentials because their energy direct debits are too high.

Simon Francis, coordinator of the End Fuel Poverty Coalition, said: ‘It’s highly concerning that low income households may have been charged too much on their direct debits, leaving them to struggle to make ends meet during the cost-of-living crisis.

‘With the huge sums being earned in interest by the energy firms, the least they can do is make sure that credit balances are not running too high, direct debits are set appropriately and the interest they have earned is either paid back to consumers or used to cancel energy debt of those most in need.

‘Of course, customers should use caution when claiming back as their direct debits may be increased by their energy firm, but making sure a supplier has a regular meter reading is the best way to ensure accurate bills.’

Jan Shortt, general secretary of the National Pensioners Convention, said: ‘People have been struggling to pay their bills and it is shocking to learn that these bills may have been set far too high.

‘Some energy suppliers will act and give credit back, most don’t so consumers need to know how to get their credit back.’

How to claim back credit on your energy bill

An Ofgem spokeswoman said: ‘Most customers build up credit during the warmer summer months which helps spread costs through the cold winter months when they use more energy.

‘However, while reasonable credit balances can help people manage their bills, consumers have the right to request credit back and should discuss their individual circumstances with their supplier.’

The steps for claiming back credit will vary depending on your supplier but should be straightforward. Simply:

- Ensure your meter readings are up to date.

- Check your energy bill or online account and see whether you are in credit or debit.

- If you are in credit, contact your energy company to request it back.

Warm This Winter has published more guidance on how you can claim back credit.

Before you take action, check that you are able to afford to pay more on monthly bills as energy firms may increase your direct debit if you withdraw your credit. If the forecasts are accurate, however, the cap will rise again in October.

Energy UK deputy chief executive Dhara Vyas said: ‘Suppliers do aim to set direct debits at a level that means accounts are in balance after winter – when higher energy usage can cancel out the lesser amount used over summer.

‘Such calculations are based on factors like previous consumption, so if there is a mild winter – as we have just had – and customers consequently use less energy than expected, that can lead to higher credit balances.

If your energy firm refuses to refund your credit, you should first complain to your supplier. You can take up a case against them with the independent Energy Ombudsman if you’re not happy with their response.

Vyas added: ‘It should also be stressed that while some suppliers have returned to profit this year, Ofgem has highlighted that they collectively lost £4 billion in the previous four years and while the figures are not directly comparable, the amount of customer debt also currently stands at £3.2 billion and remains a huge concern for the industry.’

Related claims

Yorkshire Water

Yorkshire Water and five other water companies accused of underreporting sewage spillages and discharges. Sign up to Consumer Voice for updates.

United Utilities

United Utilities and five other water companies accused of underreporting sewage spillages and discharges. Sign up to Consumer Voice for updates.

Thames Water

Thames Water and five other water companies accused of underreporting sewage spillages and discharges. Sign up to Consumer Voice for updates.